Unauthorized bank transactions can be a distressing occurrence for account holders as they often discover illicit activity only after noticing discrepancies while reviewing their bank statements. Such transactions may range from small charges to substantial amounts, significantly impacting a person’s financial well-being. It is vital for individuals to take prompt action when they suspect an unauthorized transaction in order to minimize the risk of further losses and work towards a resolution with their bank.

Quick List Of What Is Needed and Helps

- The unknown transaction name and amount

- The list of 3-5 known transactions before and after

- Contact Bank with account information

- Request an explanation of charge

- If not explained, elevate to a dispute

- Monitoring and Follow-up

In most cases, banks are legally obliged to investigate claims of unauthorized transactions, and proper resolution of such disputes can protect the account holder from monetary losses. It is essential for individuals to know how to recognize unauthorized transactions, understand the dispute process, and be aware of their legal rights and responsibilities.

Furthermore, being knowledgeable about what can be done after the dispute resolution process can help account holders safeguard their financial futures and avoid similar issues in the future.

Key Takeaways

- Recognizing unauthorized transactions is the first step towards resolution and prevention.

- Understanding the legal rights and responsibilities during the dispute process is crucial.

- Learning from the dispute experience can help individuals avoid future unauthorized bank transactions.

Recognizing Unauthorized Transactions

Spotting Signs of Fraud

Recognizing unauthorized transactions on your credit or debit card can be crucial in preventing further fraud and maintaining your financial security. Here are some common signs that may indicate fraudulent activity:

- Unfamiliar charges: Transactions that you do not recognize, regardless of their size, should be investigated.

- Recurring payments: Unauthorized recurring payments to unfamiliar companies or individuals.

- Multiple transactions: Numerous charges from a single merchant in a short period, especially if it seems repetitive.

- Unexpected international charges: Transactions occurring in a foreign country when you haven’t been traveling.

It’s crucial to be vigilant and proactive in identifying these signs of fraud to protect your finances. Know what “miscellaneous withdraw” means? Click here to learn more

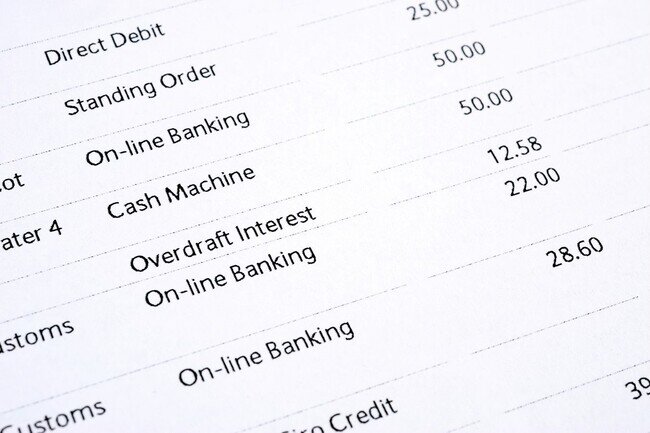

Reviewing Bank Statements

Regularly reviewing your bank statements can help you identify and dispute unauthorized transactions in a timely manner. Here are some essential tips for reviewing your bank statement for unauthorized charges effectively:

- Set a schedule: Establish a routine for reviewing your bank statements, such as weekly or monthly, depending on your preferences.

- Compare receipts: Keep your transaction receipts and cross-check them with the charges listed on your bank statement.

- Highlight unusual transactions: Point out any unfamiliar or unusual transactions and follow-up with your bank or the merchant to clarify or dispute the charge.

- Use account alerts: Many banks offer account alerts for unusual activity or transactions over a certain amount. Utilize these features to stay updated about your account transactions.

Understanding and regularly reviewing your bank statement can make it significantly easier to spot unauthorized transactions.

Understanding Types of Unauthorized Charges

It is essential to understand the various types of unauthorized charges that can occur on your credit or debit card. Some of the most common unauthorized transactions include:

- Card-not-present fraud: Occurs when someone steals your card information but not the physical card, usually during online transactions.

- Skimming: When a fraudster uses a device to collect your card’s magnetic stripe data during a legitimate transaction, such as at a gas station or ATM.

- Phishing: Criminals may try to deceive you into providing your card information by impersonating your bank or another trusted institution through emails, phone calls, or text messages.

By understanding the various types of unauthorized transactions, you become better equipped to identify potential unauthorized charges and take appropriate action to protect your finances.

The Dispute Process

Initiating a Dispute

If you notice an unauthorized transaction on your bank account, it’s essential to act quickly and initiate a dispute. Most banks require you to report unauthorized transactions within 60 days. Start by contacting your bank’s customer service and providing them with the necessary details such as transaction date, amount, and the reason for the dispute. They will guide you through their specific dispute process and inform you about what documentation is required.

Gathering Necessary Documentation

When disputing a transaction, you will need to gather relevant documentation to support your claim. This information may include:

- Bank statements: Highlight the unauthorized transaction(s) on your statement.

- Receipts or invoices: If applicable, provide proof of any authorized transactions that may have been confused with the disputed charge.

- Proof of identity: A copy of your driver’s license, passport, or another form of identification.

- Account information: Your name, address, and account number.

Organizing this documentation will help strengthen your case and make the process smoother.

While going into a branch and presenting your case so to speak, it is best to have copies and an explanation of everything as well. Have all this organized in a way that if you have to leave the info to have it looked into further they have your argument in plain language in front of them with copies of the proof from your side.

Writing a Dispute Letter

A well-crafted dispute letter is crucial for effectively communicating your request for a chargeback. Ensure the following details are included in your letter:

- Your name and address

- The date

- Your bank’s name and address

- Your account number

- A concise explanation of the unauthorized transaction(s)

- A list of the documentation you’re providing

- A clear request to investigate and resolve the unauthorized charge(s)

Your letter should be friendly and professional in tone. Be sure to keep a copy for your records and consider sending the letter via certified mail for extra security.

By following these steps and providing the necessary information in a clear and organized manner, you will greatly increase the likelihood of a successful transaction dispute. Remember to stay proactive in monitoring your account to prevent future unauthorized charges from going unnoticed or unresolved.

Legal Rights and Responsibilities

Consumer Protection Laws

In the United States, federal law provides protections for consumers when it comes to disputing unauthorized bank transactions. The primary sources of this protection are the Electronic Fund Transfer Act (EFTA) and the Fair Credit Billing Act (FCBA). While the EFTA covers electronic transactions, such as debit card purchases and ATM withdrawals, the FCBA covers credit card transactions.

These laws outline the rights and responsibilities of both consumers and financial institutions when a transaction is questioned. They ensure that banks properly investigate disputed transactions and, when necessary, provide refunds or temporary credits to the affected accounts.

Understanding Bank’s Investigation Procedures

When you report a disputed transaction to your bank, they are required to initiate an investigation into the matter. Typically, the bank’s fraud department will handle the case and may contact you for further information.

During the investigation, you may be asked to provide documentation or proof of the disputed charge, such as a receipt or invoice. This information will aid the bank in determining the legitimacy of the transaction. In some cases, you might be issued a temporary credit while the investigation is ongoing.

Liabilities and Timeframes

There are specific timeframes and liability limits provided under federal law for disputing unauthorized transactions:

- EFTA: For debit card transactions, you must notify the bank within two days of discovering the suspected fraud. In this case, your liability is limited to $50. If you report the fraud between 2 and 60 days, your liability increases to $500. After 60 days, there is no limit on your liability.

- FCBA: For credit card transactions, you must dispute the charge within 60 days of receiving the statement that contains the unauthorized charge. In this case, your liability is limited to $50.

It is essential to be vigilant when reviewing your bank statements and act promptly when noticing suspicious activity. Acting within the prescribed time limits can significantly reduce your financial liability and ensure a swift resolution to the issue.

After the Dispute

Receiving a Refund or Credit

When the dispute process is finalized, the customer may receive a refund or a provisional credit depending on the scenario. If the bank determines the transaction to be unauthorized, a refund or chargeback will commonly be issued to the account holder. This means that the funds will be restored to their bank account.

Sometimes, a bank provides provisional credit to the account while they investigate the disputed transaction. This temporary credit allows the account holder to access the disputed funds in their bank account during the investigation. However, it is crucial to understand that provisional credit may be reversed if the bank concludes that the transaction was authorized.

Preventing Future Unauthorized Transactions

To safeguard one’s bank account and prevent future unauthorized transactions, it is essential to follow a few practices:

- Utilize digital banking services, including account notifications and alerts, for closely monitoring account activity.

- Keep the PIN and security credentials confidential and change them regularly.

- Be wary of unsolicited emails, text messages, and calls requesting personal or banking information.

Additionally, maintaining communication with the bank and updating them about travel plans or unusual transactions can provide added security. By following these steps, account holders can minimize the risks related to unauthorized transactions in their bank accounts.

Frequently Asked Questions

How can I get a refund for an unauthorized transaction on my account?

To get a refund for an unauthorized transaction, you should immediately contact your bank or financial institution. Explain the situation, providing relevant details like the transaction date, amount, and vendor. They will often initiate an investigation and work on reversing the charge if found to be unauthorized.

What steps should I take to dispute a charge on my credit card that I didn’t authorize?

- Immediately contact the bank or credit card issuer to report the unauthorized charge.

- Keep records of all communications, including dates and reference numbers.

- Monitor your account for updates on the dispute process and follow any instructions provided by the bank or credit card issuer.

- Consider requesting a new credit card number to prevent further unauthorized charges.

What should I include in a dispute letter regarding fraudulent bank transactions?

In a dispute letter, include the following:

- Your name, address, account number, and contact information.

- A clear description of the unauthorized transaction, including the transaction date, amount, and payee.

- A statement explaining that you did not authorize the transaction.

- Any supporting evidence such as police reports or statements from other parties involved.

- A request for a prompt resolution and refund of the unauthorized amount.

What process do banks typically follow when investigating an unauthorized transaction claim?

Banks generally follow these steps:

- Review the account holder’s claim and gather information about the unauthorized transaction.

- Investigate and verify the legitimacy of the claim, often contacting the payee, and review any supporting documentation provided.

- Determine if the claim meets the requirements for a refund.

- Notify the account holder of the investigation results and any action being taken to resolve the issue.

In what scenarios might a bank deny a refund for a disputed unauthorized charge?

A bank might deny a refund for an unauthorized charge in the following scenarios:

- If the bank determines the account holder actually authorized the transaction.

- If the account holder did not report the unauthorized transaction within the required time limit.

- If the claim is deemed fraudulent or if there is a lack of substantiating evidence.

- If the account holder failed to take preventative measures, such as safeguarding their debit or credit card information.

How do I effectively communicate with my bank to initiate a transaction dispute?

To effectively communicate with your bank, follow these steps:

- Be proactive – Contact the bank as soon as you notice the unauthorized transaction.

- Be clear and concise – Provide a detailed description of the issue and the reason for the dispute.

- Be organized – Gather and share all relevant documentation, such as receipts, invoices, and account statements.

- Be persistent – Keep records of your communication with the bank and follow up on the progress of your dispute.

- Be cooperative – Follow the bank’s instructions and provide any additional information they may request during the investigation process.